30-Year Mortgage Rates Shoot Up Again, Hitting an Almost 3-Month High

in

News

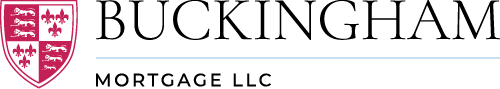

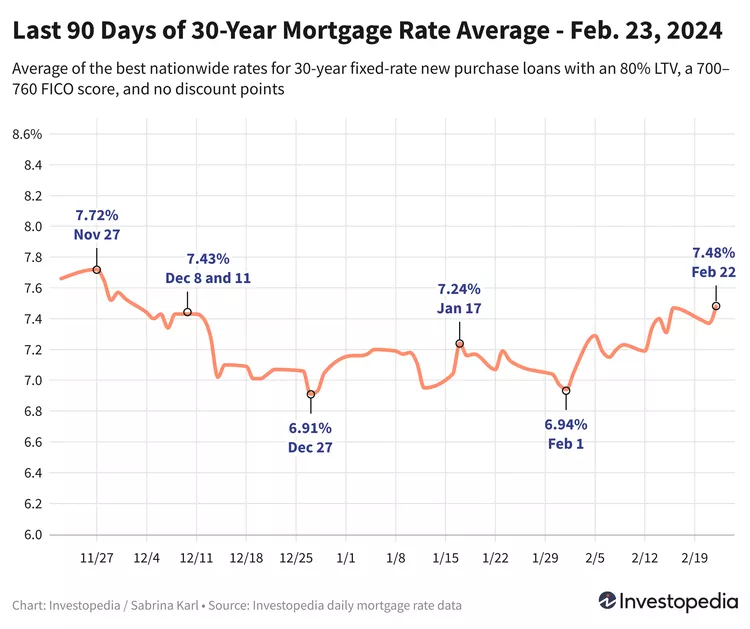

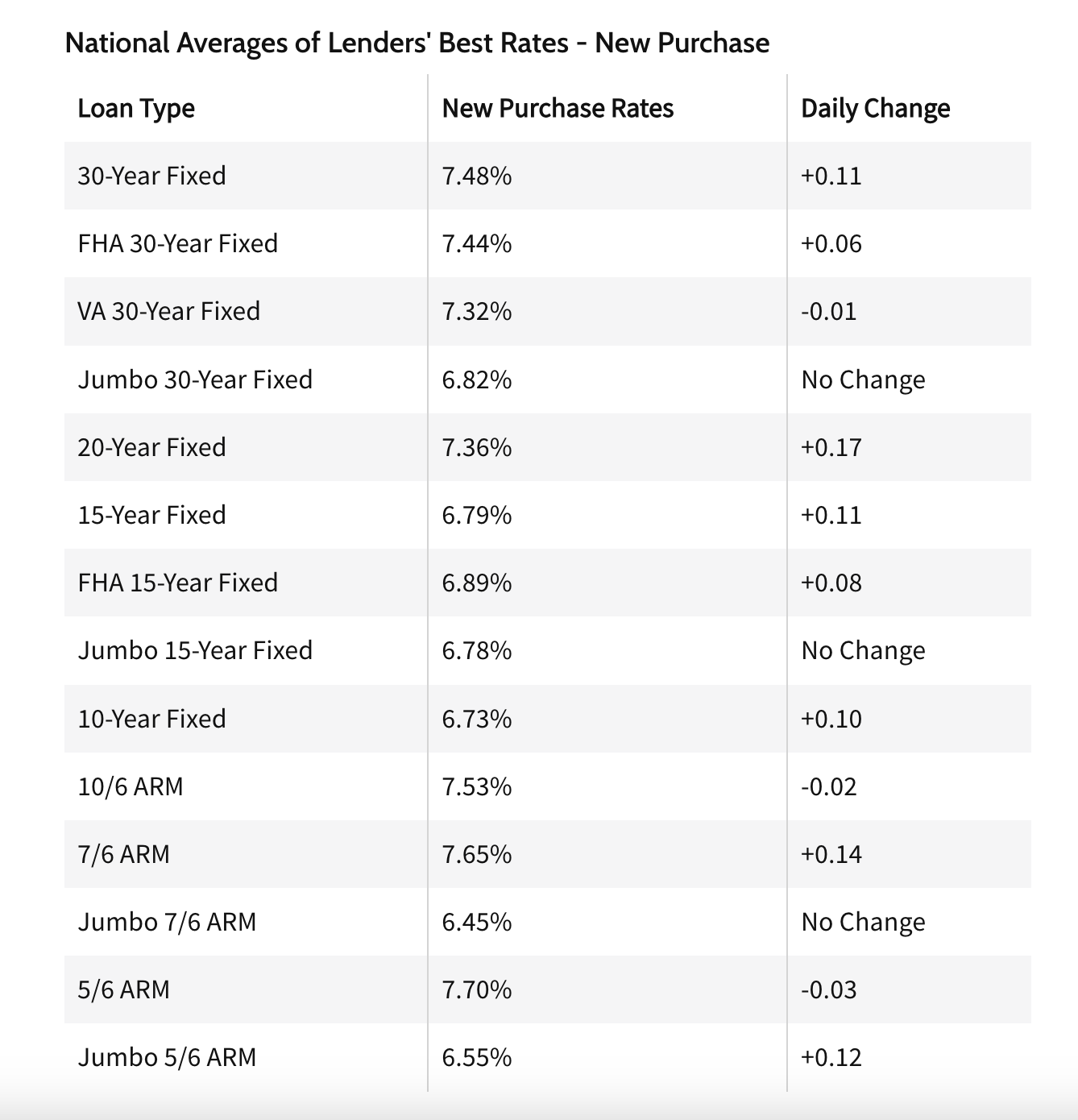

After easing a bit mid-week, 30-year mortgage rates jumped back up to 7.48% Thursday, their highest level since the start of December. Other new purchase loans saw rates either climb or hold roughly steady Thursday, while the 30-year refi average meanwhile spiked more than a quarter point.

Since rates vary widely across lenders, it’s always smart to shop around for your best mortgage option and compare rates regularly, no matter the type of home loan you’re seeking.

Today’s Mortgage Rate Averages: New Purchase

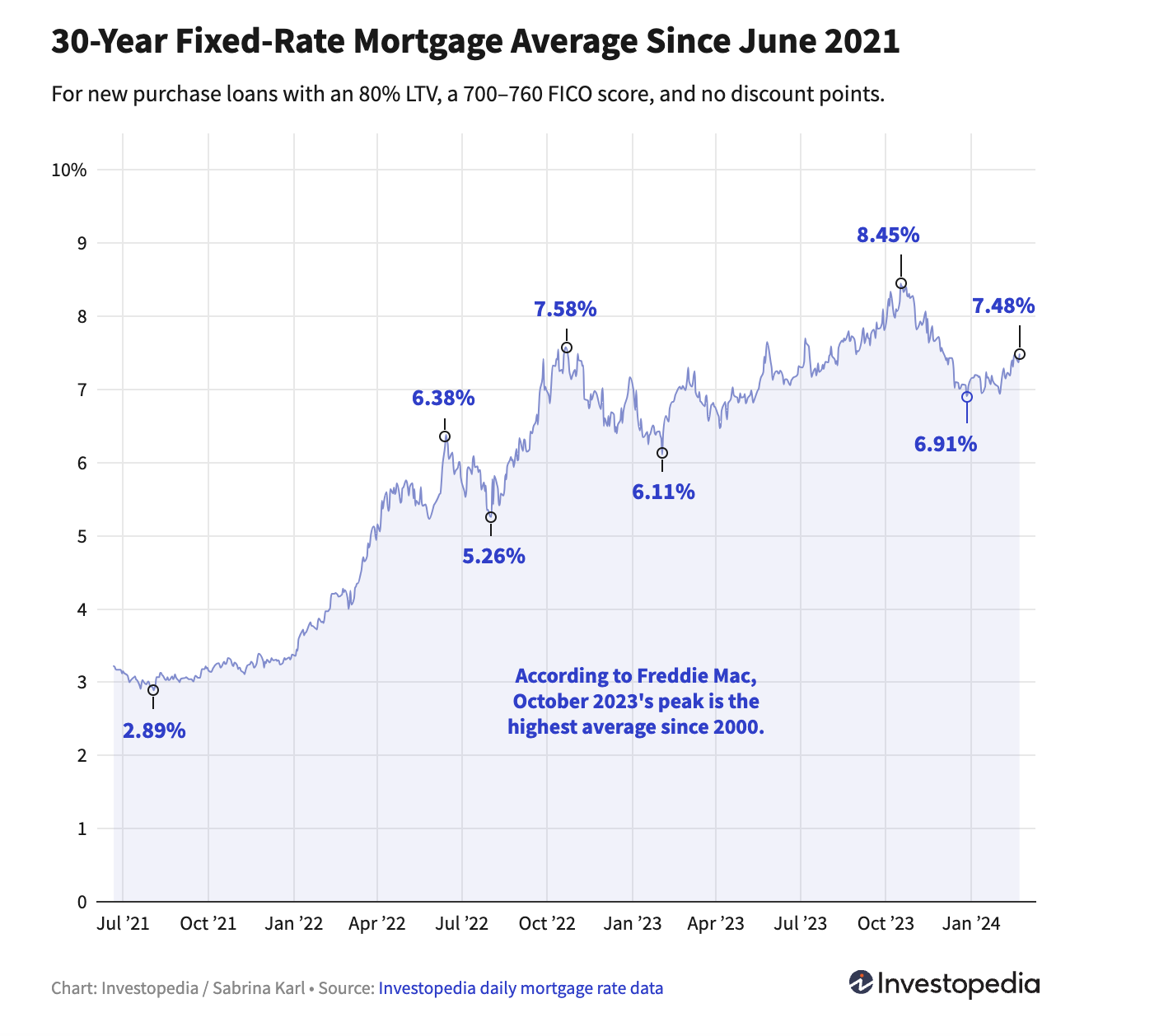

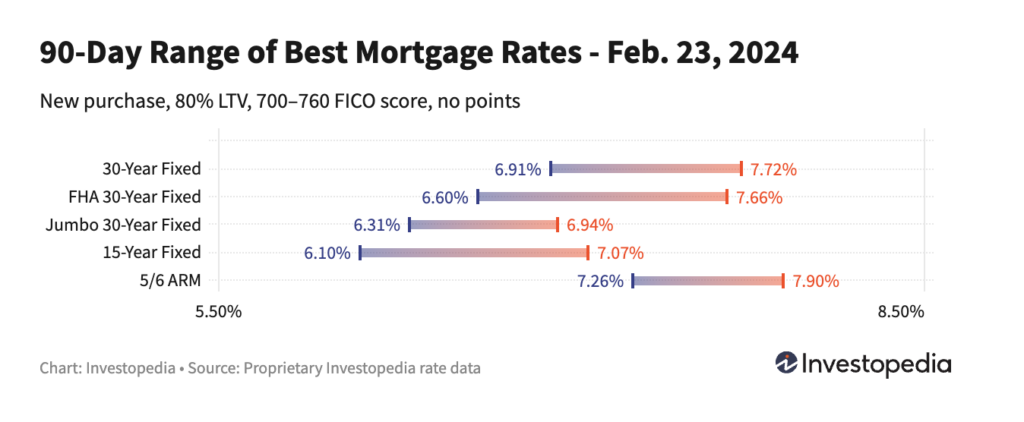

Rates on 30-year new purchase loans shot up a bold 11 basis points Thursday, returning the average to the mid-7% range after dipping a tenth of a percentage point mid-week. The flagship average is now 7.48%, the highest 30-year average since Dec. 1. Given rates dipped into 6% territory at the start of February, the current average is elevated. But it still sits almost a full point below October’s historic 23-year peak of 8.45%.

Rates on 15-year new purchase loans also rose 11 basis points Thursday, climbing to 6.79%. That’s the highest reading since Dec. 11, and is more than two-thirds of a percentage point above the seven-month low of 6.10% seen just before the new year. But back in October, 15-year rates soared to a 7.59% peak—the most expensive level since 2000.

Jumbo 30-year rates marked time for a sixth day at 6.82%. That’s the jumbo 30-year average’s highest mark since late November. Though daily historical jumbo rates are not available before 2009, it’s estimated the 7.52% peak reached in October was the most expensive jumbo 30-year average in more than 20 years.

Among other new purchase averages, several showed little or no movement Thursday, while the rest climbed. The biggest rate gainers were 20-year loans, whose average jumped 17 basis points, and 7/6 adjustable-rate loans, which saw a rise of 14 basis points.

The Weekly Freddie Mac Average

Every Thursday afternoon, Freddie Mac publishes a weekly average of 30-year mortgage rates, and this week’s reading added 13 basis points to reach 6.90%. Back in late October, Freddie Mac’s average reached a historic peak of 7.79%—its most expensive level in 23 years. But since then, it has come down significantly, registering a recent low of 6.60% in mid-January.1

Freddie Mac’s average differs from our own 30-year average for two notable reasons. First, Freddie Mac calculates a weekly average that blends five previous days of rates, while our Investopedia averages are daily, offering a more precise and timely indicator of rate movement. Second, the rates included in Freddie Mac’s survey can include loans priced with discount points, while Investopedia’s averages only include zero-point loans.

Today’s Mortgage Rate Averages: Refinancing

Refinancing rates were also mostly up Thursday, including a spike in 30-year refi loans. After sinking 21 basis points Wednesday, the 30-year refi average surged 28 basis points yesterday. That stretches the spread between 30-year new purchase and refi rates to a somewhat-wide 48 basis points.

The 15-year refi average meanwhile added the same 11 basis points seen for new purchase loans, while the jumbo 30-year refi average continued its holding pattern for a sixth day.

Besides the 30-year refi average, the biggest refi rate gainers Thursday were 20-year loans and FHA 30-year loans, which climbed 18 and 14 basis points, respectively. The only refi average to dip more than a couple of points was 7/6 ARM loans, whose average subtracted 5 basis points.

Source: Investopedia